Topics: Financial Think Economic Literacy Monetary Security

After you sign a buy offer, you are finalizing a legally binding arrangement. Oftentimes in addition set out serious money. For individuals who straight back from the package with no reasoning that is legally recognized, your cure your own earnest currency, and this can be several thousand dollars.

As to acquire a house is one of the premier commands you are able to build, you want to go into the price cautiously. You signal a contract that doesn’t are employed in the favor, however also don’t want to provides unnecessary contingencies one a provider would not undertake their quote.

One of the most preferred contingencies you can so you’re able to a great buy package is actually a funds contingency. Insights what it is and just how it truly does work is important.

What is actually a finance contingency?

A financing contingency will give you a way to right back regarding a purchase package as opposed to dropping the serious currency if you’re unable to submit the financial support.

Its an undertake the vendor allowing him/her know that you already shielded preapproval of a loan provider, however you lack latest recognition but really and require a way to help you back away when the one thing appears additionally the bank converts the job off.

How does they performs?

A loans contingency is quite detail by detail. It lets the seller know what terms and conditions you’re preapproved for and what you are able deal with nevertheless move forward for the sale. That way if any of one’s terms and conditions cannot finish functioning out, you can right back out of the sales.

- Loan amount Allowing owner understand how far you ought to obtain so you’re able to buy the home. Should your bank can’t accept you for the amount borrowed, you might must back out from the purchases.

- Financial sort of So it refers to the type of financial you will get, whether it is conventional, FHA, Va, or USDA. Some vendors won’t take on certain kinds of capital, such as for example Va, so this is a significant factor.

- Label This is why much time you are going to borrow the money. For individuals who submit an application for good fifteen-12 months term, however are unable to become approved because of it, you can back out of the profit, or you might shoot for a thirty-year term.

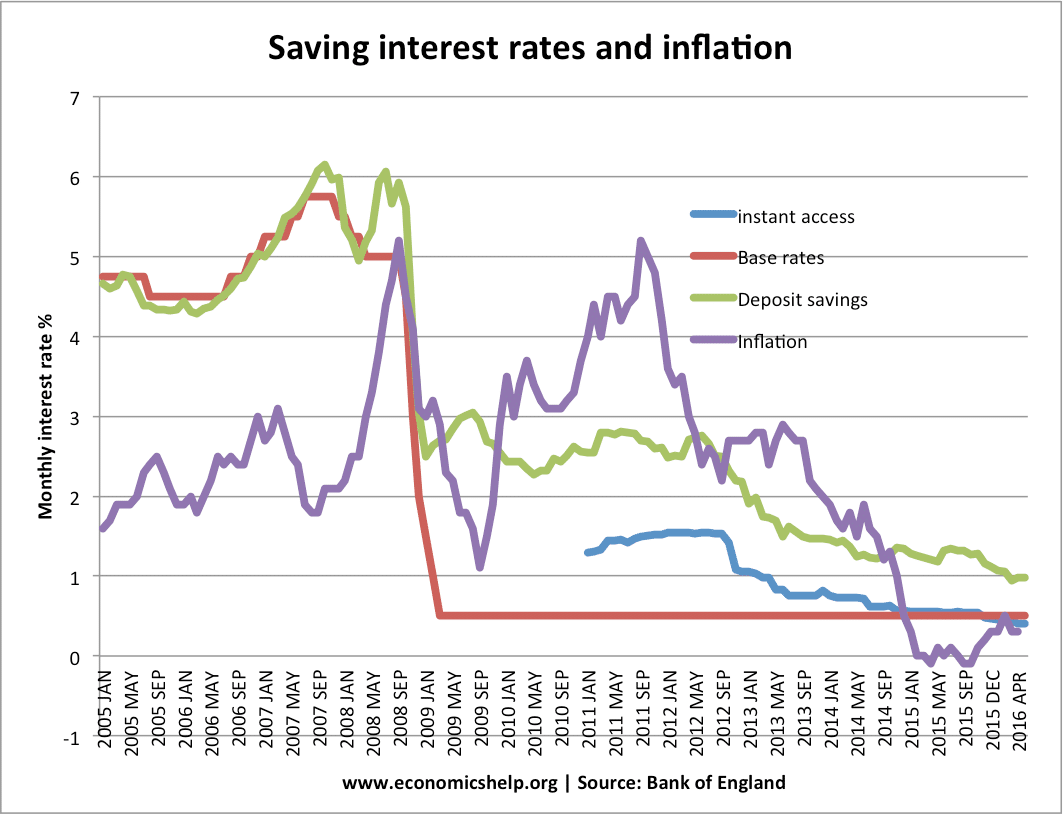

- Interest For many who did not lock your speed from inside the yet and cost improve much, you can back from the marketing once payday loan Stevenson the rate wouldn’t getting just what lender accepted you having.

Whom requires a loans contingency?

Anyone that are investment the purchase away from a property may use a loans contingency. Even though you has higher borrowing from the bank and you may a large down-payment, one thing you will definitely nevertheless not work right. There’s never ever a substantial make sure you’ll be able to romantic on your mortgage if you do not have the finally recognition.

Loan providers cannot offer latest acceptance up until he has all of the criteria came across on the financing hence boasts affairs affecting the house, including the appraisal and you will name works.

Unless you’re expenses bucks for the possessions, a money contingency may help. Once you know past a reasonable doubt even in the event the financing goes through or which you have solutions, you could potentially ignore they.

Good pre-approval is conditional acceptance. It informs you what you’re accepted for considering just what the lending company enjoys viewed so far and you may exactly what conditions needed. The pre-approval letter includes all requirements you must meet so you’re able to get the latest approval.

When you have a good amount of issues that relate to their finances or your problem, you may choose the credit contingency whether your financial finds out a conclusion to turn the loan down.