After you have repaid very otherwise all your borrowing notes, your credit score will be raise considerably because of the 30 points or higher

You may be eligible for an FHA loan that have a credit rating as little as 580 having an effective step three.5% advance payment.

When your credit history is lower than 580, you might still qualify with good ten% down-payment. FHA financing can be acquired having 15 and you will 31-12 months conditions, and you can fixed and you can adjustable cost arrive. More often than not your wont be able to get pre-accepted having an excellent FHA home loan rather than a credit assessment otherwise query. Consult a home loan prequalification as opposed to a credit assessment off HUD approved lenders.

What do i mean by compensating products? Imagine if you have a credit score regarding the reduced 500’s and generally are having problems actually delivering qualified for FHA loans. When you yourself have some other more powerful economic facts to your benefit, the financial institution, representative or lender get thought providing you a good pre-approval page to own home financing. Some of the compensating activities that one may go for include:

- A extreme downpayment (10% or higher)

- Straight down debt so you can earnings ratio (pay down the latest stability of one’s playing cards!)

- Greater than average earnings

- Zero biggest expenses

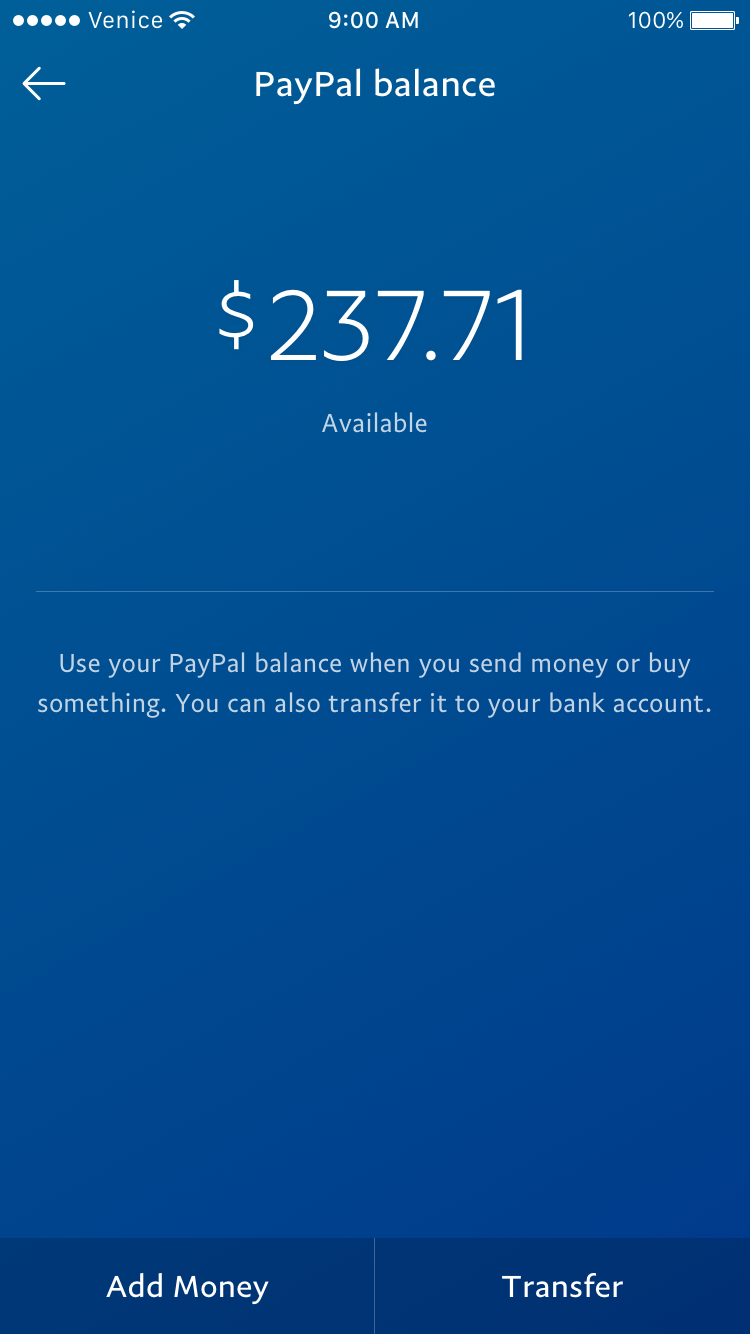

- File coupons (Inform you proof of well-known dollars reserves)

- Steady work history (years with the exact same manager)

- Already expenses comparable book percentage while the recommended mortgage payment

It also is quite of good use when you can reveal, even after poor credit, that you have already been purchasing your own bills punctually on just last year or more. Loan providers, particularly FHA-accepted businesses, expect to look for individuals with earlier credit troubles.

They certainly were well-known for the monetary crash, and never usually on the command over the newest debtor. Individuals destroyed operate, missing era, discounts tend to evaporated, and you may people’s credit scores got a beating.

But you can beat that crappy-borrowing mortgage a little if you possibly could make suggestions are straight back in your feet economically within the last 1 to 2 age. Zero later costs with the anything, ideally, without levels provided for choices are just what to aim to possess.

It is helpful to features very little credit card debt especially when you are trying to get pre-recognized having less than perfect credit. Insurance firms less unsecured debt on your own name, you will feel like a reduced amount of a risk into bank, and work out a zero credit assessment financial so much more you are able to.

We know. Proper, but a car loan are a secured, payment mortgage. It is covered a specific amount of days on an effective certain amount, and is also protected of the an item of assets the car. As much as possible let you know a loan provider your and come up with vehicles money punctually to own a year or even more, it may help you to receive a Missouri short term personal loans mortgage pre-approval that have bad credit or restricted borrowing from the bank.

You to will bring us to an alternative point: In a few ways, it could be much harder to obtain a pre-acceptance getting a mortgage with no credit at all than simply bad credit. If you aren’t with your credit whatsoever, there is no way that a lender renders a wisdom regarding the quantity of likelihood of stretching you a degree page to possess a mortgage, in the place of a no credit score assessment mortgage having a high focus rates.

This may sound uncommon to adopt bringing a car loan; at all, this is a new form of loans, correct?

This is exactly why it’s very employed for somebody which have crappy otherwise minimal borrowing from the bank to obtain an auto loan while making payments vigilantly. This may imply that you can utilize create a payment mortgage timely, which can demonstrate that you’re a reasonable chance to own a mortgage. This should help you be more eligible for home financing, as opposed to a no borrowing financial.