Citi administers the new HomeRun Program and you may assesses the eligibility into program

This new Citi HomeRun Home loan Program enables consumers having reduced-to-moderate incomes to afford mortgages and purchase home. The fresh new HomeRun Financial Program enables qualified borrowers to purchase a house that have a deposit only step three.0% of the house price to have an individual house, 5.0% getting a flat otherwise co-op and you will 10% to own a two equipment possessions. In the place of almost every other lower or no downpayment home loan programs, the HomeRun Program need borrowers while making the very least personal economic sum of just one% on the the down-payment getting a single home and you will 5% for a two tool family. The remainder part of the deposit may come from a good present or deposit direction program.

One of many trick advantages of the new Citi HomeRun System are you to borrowers commonly expected to shell out an initial or lingering individual financial insurance rates (PMI) commission, hence minimizes their settlement costs and you will complete month-to-month houses expenses since the versus equivalent applications. By eliminating the level of financing borrowers must lead after they purchase a property and you can and make lenders inexpensive, the brand new Citi HomeRun Financial Program produces owning a home far more possible to have consumers with restricted money.

While finding the fresh new Citi HomeRun Program, you need to get in touch with Citibank from the calling, visiting the Citibank website otherwise going to a city department

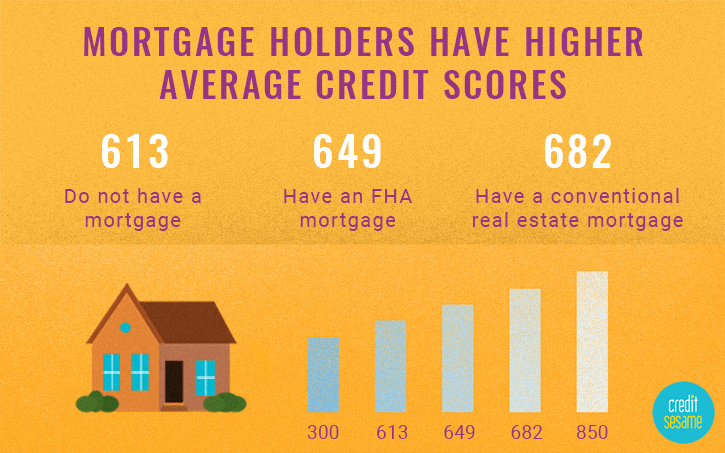

The Citi HomeRun Financial program competes that have regulators-backed lower / no downpayment financial programs including the FHA, Virtual assistant and you may USDA programs and conventional reduced / no advance payment applications such as the Lender out-of The united states Sensible Mortgage Provider, Pursue DreaMaker System, Wells Fargo yourFirst Mortgage and Federal national mortgage association Family Able programs. Regardless if like other companies, the new Citi HomeRun System demands a borrower monetary share of just one% – 5%, with respect to the assets type, compared to the other businesses which need zero borrower financial sum and permit individuals to fund 100% of its down-payment using a gift or advance payment offer. The HomeRun System, although not, has the benefit of sector home loan rates which might be competitive so you’re able to conventional software and need no PMI costs, making it less expensive to acquire a house. Definitely review and you will learn several zero otherwise low-down commission financial applications to short term loans Del Norte find the one that best matches your need.

- Capability to get a house that have a reduced down-payment

- Business home loan rate

- Zero private financial insurance policies (PMI) needed

- Several unit features meet the requirements to have program

- Permits mortgage number over the standard conforming limitation to own more expensive components

- Accessible to each other basic-some time and repeat homebuyers

- Requires high lowest debtor private financial contribution (1%) than equivalent software

- Borrower earnings limitations

- Higher deposit required for apartments, co-ops and two equipment features

Consumers sign up for and obtain a good HomeRun Home loan regarding Citibank. Consumers one be eligible for the application form are required to create an excellent deposit off 3% of the property purchase price getting one family home since the much time given that loan amount was below the standard compliant mortgage restrict ($726,200). To own single nearest and dearest features during the more expensive areas which have loan numbers between $726,2 hundred and you can $1,089,300, you are required to build a downpayment of five%.

To possess apartments otherwise co-ops, individuals must create good 5% downpayment. To own a-two tool possessions, you have to make a great 10% down-payment so long as your own mortgage count was underneath the standard conforming mortgage restrict and an effective 15% downpayment when your loan amount was anywhere between $726,2 hundred and you can $step 1,089,3 hundred.

In the event individuals are required to make the very least monetary sum away from 1% to possess just one tool property, they’re able to determine whether they would like to result in the complete down payment through its own funds and other supplies. Particularly, getting just one house which have a purchase price away from $100,000, consumers have to generate the very least advance payment out of $step three,000 (3%) and really should contribute $step one,000 (1%) from their own personal finance into the the latest down payment. Individuals that don’t have sufficient individual fund for the entire deposit by themselves is also merge the newest HomeRun Financial Program having a birthday gift, manager system or down-payment guidelines offer to pay for brand new remaining down-payment advance payment and to assist spend to possess settlement costs.

Having fun with a down payment offer or gift permits your house customer to find the property that have a lesser individual monetary share. Like, in the event that a home client wants to get a $100,000 home, they might obtain good $97,000 HomeRun Mortgage off Citi, contribute $step 1,000 of one’s own finance into the fresh down-payment and you may located good $dos,000 down-payment give to shop for your house with a lowered private economic sum. The consumer could be able to qualify for closure costs guidance program to cover all or section of their or their own closing costs.

Deposit has and you may closing prices guidance programs are typically considering from the county and you will local construction firms and you can commissions. Construction organizations and profits aren’t-for-earnings organizations that offer a selection of family client assistance applications. Concurrently, particular people provide advance payment advice grants or loans to own staff.

Home buyers trying to utilize the Citi HomeRun Home loan Program which have a down-payment otherwise closing prices direction program should submit an application for the application form that have Citi and then have contact its local housing payment (or manager) to apply for the help system. Sometimes, Citi could possibly get suggest certain housing organizations otherwise organizations for borrowers so you can work at together with homes providers may possibly provide additional info so you’re able to assist guide borrowers from the property and you will financial processes.

We recommend that you evaluate terms and conditions also interest rate, closing costs and you will Annual percentage rate to have a great Citi HomeRun Mortgage for the terms to other low down commission mortgage software. Contact multiple lenders on the table below to learn about this new low-down commission home loan choice they give.