The new 29-season, fixed-rate financial is considered the most preferred financial throughout the You.S. According to Freddie Mac, nearly ninety% out of American home owners has actually a thirty-seasons, fixed-price loan. Although not, because the newest 29-seasons mortgage is actually common does not always mean it is always the latest correct one for you!

Let’s mention fifteen-season instead of 30-12 months mortgages, and exactly how they may be able impact the sized your payment per month, and the amount of interest it is possible to spend along side longevity of the loan.

So what does an effective 15-Year or 30-Year Financial Imply?

15-season and you may 31-year mortgage loans refer to the fresh loan’s title-that’s, just how many many years you are going to need to repay the cash you borrowed to invest in your residence. By taking out an excellent 15-year mortgage, the borrowed funds need to be paid back during a period of fifteen years. When you yourself have a 30-12 months loan, you will have to pay it back during a period of 3 decades. you will need to pay the attract you borrowed by the termination of the loan’s label.

Exactly what are the Advantages of a beneficial fifteen-Year Financial?

A great 15-year mortgage has some benefits. 15-12 months mortgage loans routinely have straight down rates that assist it can save you money on attract by paying away from their home loan faster. You can essentially create your house’s guarantee faster and pay off your home loan more quickly that have an effective fifteen-12 months financing, also.

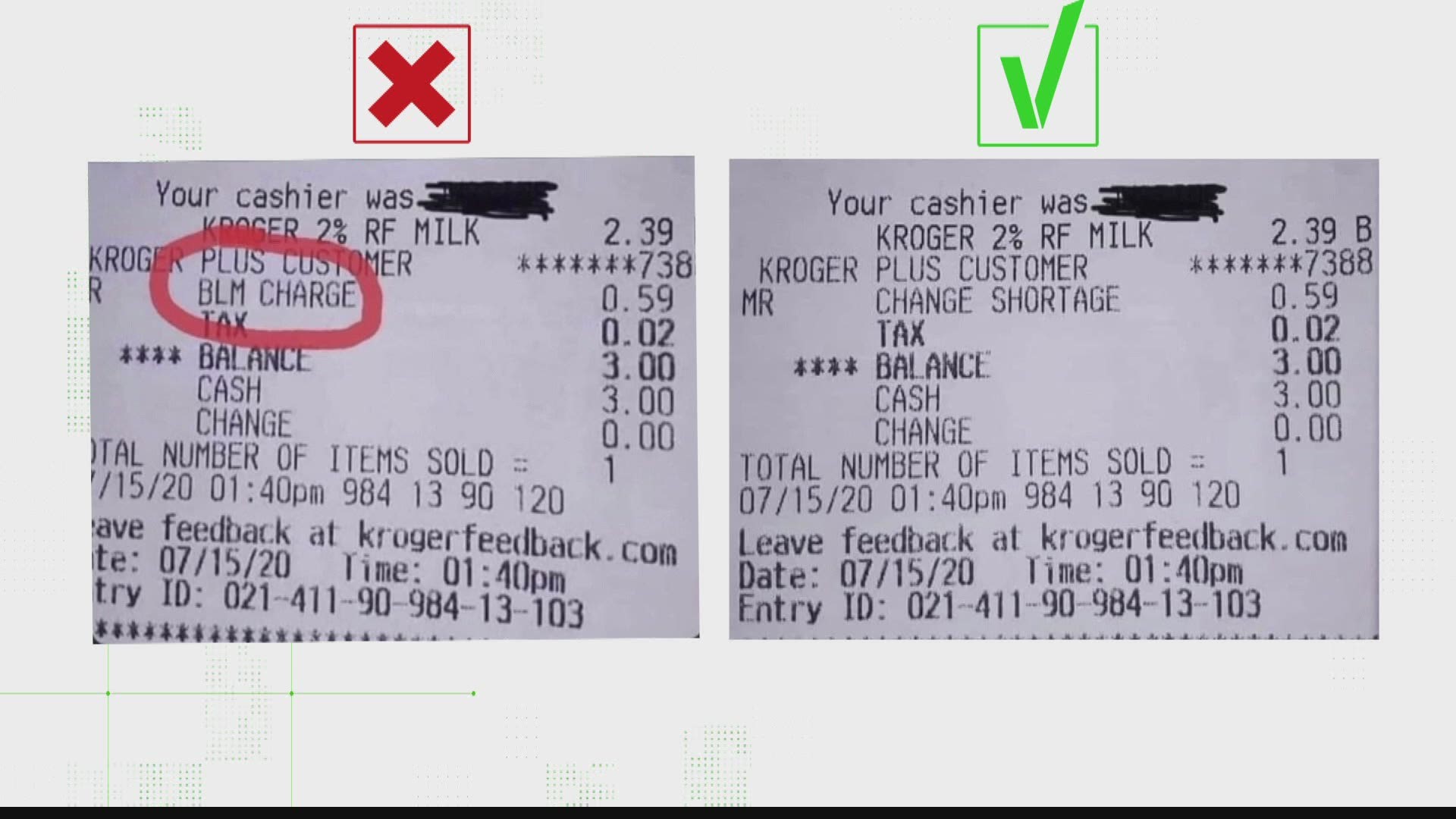

This new drawback off fifteen-seasons mortgage loans is they always include increased lowest payment per month. You will be necessary to shell out far more per month with a 15-season financial than simply you will be necessary to pay with a beneficial 30-seasons home loan having borrowing from the bank the same amount of cash. (The amount of money your use might be called the home loan prominent.) See both of these attempt computations:

As you care able to see during these instances, the fresh fifteen-year home loan you will save over $forty,000 in the attract money however, require you to shell out a great deal more for each and every day. Check out the fifteen- versus. 30-Season Home loan Calculator so you can tailor your prices to have desire and you will month-to-month repayments.

Exactly what are the Benefits of a 30-Seasons Home loan?

The main benefit of a 30-seasons mortgage is the straight down minimal monthly payment these loans need. As you can see on example a lot more than, new 30-season home loan need one to pay a small over $900 smaller each month, than the fifteen-12 months mortgage. This will generate purchasing a house inexpensive and provide you with alot more autonomy on the month-to-month plan for almost every other debts and expenditures.

For it straight down payment per month, you’ll generally shell out a high interest rate and you may shell out far more profit attract along side longevity of the borrowed funds than your perform with a 15-year home loan.

Is it possible you Build A lot more Repayments into the a thirty-Season Home loan?

Sure. Most loan providers assists you to pay them a whole lot more per month than the minimum required. Thus you can get a thirty-season financial however, pay it back as if it absolutely was an excellent 15-12 months mortgage. The advantage of that is self-reliance. You can pay $600 additional 30 days, $three hundred more the following week, and absolutely nothing most the next week.

Many people such as the reassurance from understanding he’s the option of paying far more per month or perhaps not, instead of getting locked into always making the large fee. A lowered percentage normally hop out more funds on your own cover almost every other bills, save getting disaster expenditures such as an urgent domestic repair, help save you for school or senior years, and more.

You’ll generally spend more income in interest by simply making even more money on the a thirty-12 months home loan than simply through getting a fifteen-season home loan but people additional mortgage repayments commonly however save cash in attention!

Could you Re-finance a 30-Year Home loan towards good 15-Season Home loan?

Yes. You might typically favor a 15-season financial label whenever you re-finance. Home owners have a tendency to refinance regarding a thirty-year so you’re able to good fifteen-seasons financing whenever its profits have remaining up, plus the highest lowest monthly installments much more affordable. You could usually generate additional home loan repayments into 15-year mortgage loans, too.

Are good 15-12 months otherwise 29-Year Home loan Right for you?

You ought to glance at the large picture of your finances, including your mortgage repayment, most other bills, expenditures, coupons, and you may monthly money while you are determining between a good 15-year and you can 29-12 months mortgage. Specifically, consider if a lesser monthly payment or spending less in appeal over the years is more crucial that you your right now.

Versatility Mortgage principal site is not an economic advisor. The ideas intricate over are to own educational aim merely and therefore are not money or economic advice. Demand an economic advisor before making very important private economic choices, and request an income tax mentor to own information regarding the fresh deductibility out of appeal and you may charges.