Graduating from college is a big milestone that frequently signifies new commencement from yet another section: dive towards staff members, moving to a new city, or at least contemplating the very thought of purchasing your first domestic. Since the concept of to invest in property immediately after college you will check challenging given college loans and you may restricted functions experience, it is really not an unattainable dream.

In reality, that have best financial thought and a keen understanding of the real property industry, present graduates normally successfully make changeover out of dorm bedroom to homeownership. Whenever you are intrigued by the prospect and you can desperate to read tips change this relatively bold goal to your a real possibility, keep reading. We have been about to inform you one step-by-action book geared to fresh graduates like you.

Determine Value

Navigating post-university economic responsibilities should be tricky, and you will incorporating home financing into merge demands prudence. Begin by mapping out your most recent and you may projected financial land, accounting per detail regarding regular expenditures such as groceries in order to extreme outgoings such as student loans. It is also imperative to reason for prospective change, such as income increments otherwise unplanned expenses, in order for your financial budget stays versatile. Talks with personal loans in New York monetary advisors otherwise using on line financial calculators can then increase affordability facts.

Which will make a realistic property budget, go with your home-associated expenditures (related financial, utilities, and you will property fees) to get doing one-third of your own monthly outgoings. Remember to in addition to be the cause of you to-date expenditures such closing costs. Consider future repair and you will prospective homeowners relationship charge too. Having a clear monetary picture, you could potentially determine whether the new instantaneous diving to help you homeownership is actually possible or if a temporary phase out of leasing or sticking with family unit members will be alot more wise. Constantly prioritize enough time-label economic balances more than brief-identity wishes.

Cut having a deposit

Once you’ve had a resources at your fingertips, focus on the most of the-essential downpayment. Generally speaking, 20% of the property’s worth is the gold standard for an all the way down percentage. Particularly an expense guarantees you have good collateral throughout the score-wade, resulting in a great deal more beneficial financial terminology. But really, choice for example FHA funds you are going to eradicate which requirement to since reasonable once the 3.5%. Additionally, particular regions or programs you are going to promote first-go out homebuyer incentives which can help into the appointment which demand.

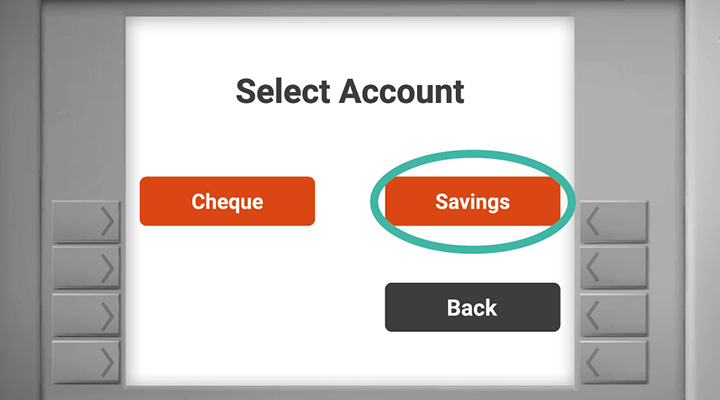

For perspective, a home worth the You.S. median away from $250,000 might have an excellent 20% deposit regarding $50,000. So you’re able to methodically save, consider allocating a predetermined part of all the paycheck toward a faithful savings account. Mention choices such as large-give deals profile otherwise envision automated transmits to make certain consistency. Playing with on line discounts membership, not the same as their regular checking levels, is also curtail natural paying and help construct your finance through the years owing to accumulated attract.

Manage your Credit rating

A robust credit rating can be your pass never to simply protecting that loan and in addition opening competitive rates. Begin by ascertaining your rating by using the yearly 100 % free evaluate provided by biggest credit bureaus. If you’re something more than 700 are deemed self-confident, there’s always area for update. It is well worth listing one even a small boost in their get may cause rather greatest rates of interest, helping you save plenty along the longevity of a loan.

With understanding on the credit history plus ranking your effectively whenever trying to pre-approval to possess lenders or interesting that have realtors. This knowledge provides you with a bonus through the deals and you will domestic options. Whether your borrowing from the bank fitness means an excellent enhancement, imbibe borrowing-amicable designs such as for example quick obligations money, smaller charge card dependence, and you may continuously remembering all of the economic commitments. Big date will be your ally, and even brief, consistent developments can transform their credit profile more days.

Speak to Real estate professionals

Having funds manageable and you may a master in your credit health, it is time to embrace the newest pleasing stage: domestic search! Build relationships legitimate real estate professionals that will give facts designed on the book needs and you can budget. The expertise and you can regional field degree will likely be indispensable, tend to sharing ventures otherwise features you can overlook your self. Contemplate, if you are the first home presents a life threatening milestone, it does not must be your own forever house. Strive for a balance anywhere between affordability and you will straightening together with your immediate desires. All the possessions has its own advantages and disadvantages, therefore ensure that your selection resonates that have both the cardiovascular system along with your finances.

As to why Like Mares Mortgage: Him or her home based Buying Profits

Deciding on the best mortgage company plays an integral role in the ensuring your residence-buying feel are effortless, secure, and you will tailored for the demands. From inside the a good ount, Mares Home loan exists as the an excellent beacon off precision. The ethos, significantly rooted in sincerity, integrity, and you can excellent customer care, set all of them apart. This type of are not only buzzwords to them; it is a heritage, upheld and you will enriched as the Cutberto Hernandez first started his excursion inside the 1993.

That have Mares Financial, customers aren’t just quantity. They truly are handled because appreciated some body, deserving of official interest. That it household members-owned and operated providers brings more than simply simple funding choice. They seek to incorporate worthy of one expands better beyond the latest exchange, planning to work for readers in the long run.

With more than 2 decades of experience, Mares Financial stands since the a stone-good place, that have carved their niche in the industry, not just with the thorough financing products close conventional, industrial, and you can regulators-recognized selection and with regards to dedication to in control lending strategies. Their organization towards National Relationship off Mortgage Gurus underscores the moral power. In addition, their creative method, playing with equipment such as for example Loansifter, guarantees subscribers get the most acceptable cost, examining products out-of over 175 banking institutions all over the country.

Regarding huge sea regarding financial providers, Mares Financial sails as master powering, support, and you may making certain that your ideal off homeownership are knew that have faith, openness, and you will a customized touch.

Out of College Scholar to help you Homeowner

Transitioning regarding college to the real life is a significant action, and buying property after can feel including a marathon dive. But because the we’ve got depicted, into the proper financial believe, a clear knowledge of the value, diligent protecting habits, proactive credit management, and also the help of experienced real estate professionals, that it fantasy are from the out-of-reach.

Of these desperate to make this transition much easier and more insightful, you should never embark on so it excursion by yourself. Mares Mortgages focuses on guiding current graduates from the homeownership techniques. With their professional advice and you may designed selection, you could potentially navigate the causes of purchasing a property with certainty. Dive in the 2nd adventure; assist Mares Mortgages be your compass.