What exactly is on your own economic so you’re able to-manage number? It could be paying off credit card debt. Or even it is you to kitchen reno you’ve been thinking about.

For people who own a property, you’ve probably an approach to get the currency you would like. Some people call it providing cash-out otherwise leverage your own guarantee. Whoa. You should not score like into the language. We’ll explain the difference in a cash-out refinance mortgage and you will property equity mortgage , incase every one might make experience.

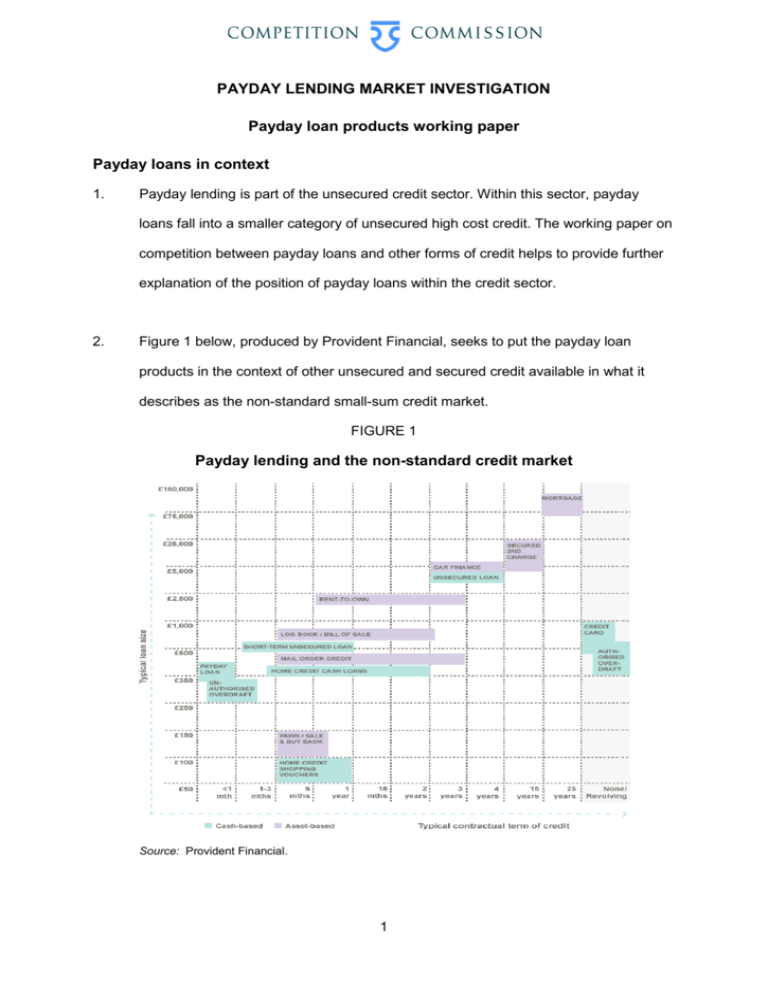

Two how to use your property equity

Having collateral setting you reside really worth more than what you owe inside. Guarantee is the residence’s worthy of with no amount your debt with the their mortgage.

A profit-out re-finance and you can a house collateral financing are two an approach to fundamentally turn your home guarantee into spendable fund. Both are mortgages. In both, a portion of their guarantee is moved about financial to help you your when it comes to currency that can be used into the debt priorities.

What exactly is a money-away refinance?

A cash-away refinance loan changes your dated financial with a new, large financing. The newest financing try bigger whilst is sold with:

You are approved (yay!) incase you sign-off to your loan, the lending company pays off your own dated financial and offer the $50,000 distinction for your requirements from inside the bucks. This is when the latest “cash out” part is available in.

Going forward, you’ll create monthly premiums up against the the, large loan. Meanwhile, you can use the additional bucks practically in any manner you instance.

The new repayment label into an earnings-away refinance loan is usually 15 otherwise thirty years, however lenders also provide ten and 20-seasons alternatives.

What’s a home collateral mortgage?

So how really does property equity mortgage works ? Our home guarantee financing is the second home loan. The lender have a tendency to look at the borrowing from the bank to make visit here sure you satisfy their minimal requirements. Might make sure your revenue or other expense, and hire a keen appraiser to find the market price of your home. The individuals details are needed to regulate how far you could potentially obtain.

Once you get the household guarantee loan, you’ll still create your mortgage payment per month, and you’ll including generate a payment per month against the domestic security financing.

Cash-aside re-finance and you can home guarantee mortgage similarities

Cash-out refinance funds and you may house collateral loans have a similar goal: Assisting you to turn their security toward dollars you need. That is the most significant resemblance, that is where are a few way more:

Liberty. Whether you have made a property equity mortgage or a finances-out home mortgage refinance loan, you have got a good amount of liberty to determine what direction to go with that money. You might use all of it for one larger expenses or perhaps to protection a small number of shorter expenditures. Whether or not we wish to combine handmade cards, assist their d relationships, or improve your dated appliances, you could choose.

Income tax gurus. Interest on the bucks-aside refinance finance and household security fund is tax-allowable . To qualify for a tax split, you must use the financing continues to switch or fix your house, along with so you can itemize your own write-offs when you document their taxation get back.

Repaired interest. Cash-aside re-finance loans and you can household equity financing usually have fixed appeal prices. That means their speed would not alter as well as your payment per month wouldn’t alter sometimes.

Financing limitations. No matter what far guarantee you have in your home, really loan providers won’t allow you to borrow every thing. The lender’s different, but the majority want you to help keep your complete personal debt lower than 80% to help you 85% of house’s worthy of.

Home loan. Cash-away re-finance fund and you may house equity funds is both mortgage loans. Your promise your house toward lender (also known as using it given that security), hence lowers the fresh new lender’s exposure. Money which might be supported by an asset like your home generally have keep costs down than finance which aren’t. That’s why mortgage and you can household security financing cost normally have down rates of interest than playing cards.