In the event the avenues do much better than We predict at any area along side twenty-five-year title, then i can be option regarding purchasing much more so you can paying off the attention-simply mortgage until the loans gets owed, and maybe even deploy swelling sums liquidated regarding my ISAs up against the mortgage (no matter if it’s hard in my situation to conceive of doing can dropping several of my personal beloved ISA wrapper…)

The new Accumulator altered his notice during the an identical-ish situation and you can decided to focus on reducing their financial obligations in the place of maximising his using gains. Zero shame where!

2. You are not reducing the capital you are able to in the course of time are obligated to pay

The second in addition to excellent argument would be the fact settling, say, ?400,000 is an enormous slog for most of us, and you may you would certainly be better off starting very early.

Sticking with my ?400,000/2.5% analogy (and rounding for easier training) in the first season out of a payment financial might pay ?9,860 when you look at the desire. You might pay just regarding ?11,666 of your the financing.

The brand new figures get best over time. From the seasons ten you will be paying down ?fourteen,610 a year within the funding, that have below ?eight,000 going on notice. This is because the previous repayments has actually shrunk the debt that attention is due toward.

At a far more over the years normal mortgage speed away from 6%, you might shell out nearly ?24,000 within the demand for year one thereon ?eight hundred,000 financing, and just ?7,000 of one’s resource.

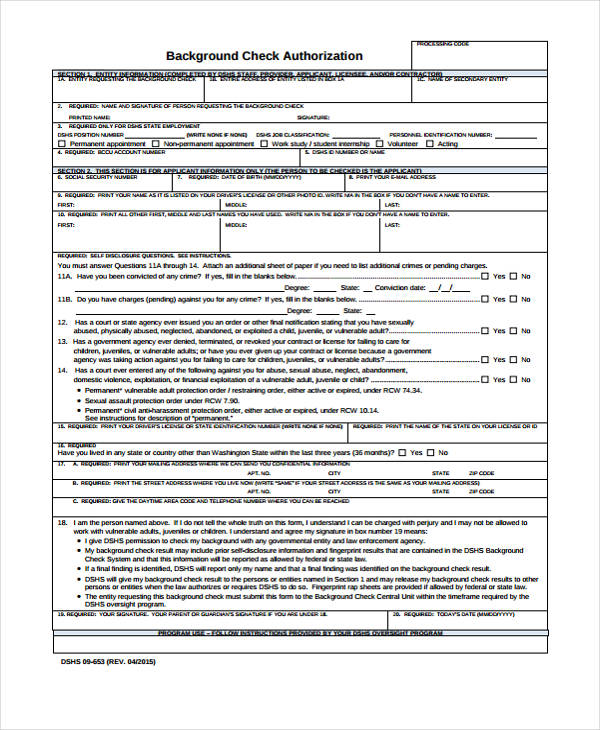

Is an illustration of the interest/money separated under good six% program. See just how long it takes to have financial support payments so you can exceed attention payments:

Definitely we do not already reside in an effective six% routine. You could believe which have today’s low pricing that it is good great time having Arkansas no credit check installment loans a payment home loan and clipped your long-identity loans, exactly since the majority of the costs are getting on financing.

It’s just sometime disguised, since when a financial rents you currency to acquire property, it-all becomes wrapped up in one single payment.

step three. You’re not smoothing your homes exposure

The stock market appears wobbly, therefore in lieu of using I will make some most money into my mortgage so you can place far more toward possessions sector alternatively. You simply can’t go awry with home!

I’ve actually got a pal suggest in my experience you to definitely paying down their financial over the years (plus with well over-payments) is like pound-costs averaging towards the stock-exchange.

When you purchase a house happens when you have made their exposure’ on the housing industry. Their publicity in the years ahead ‘s the property you bought. The expense of you to definitely house ‘s the speed your paid down whenever you purchased it.

Everyone remove a mortgage to purchase our house. Exactly how we choose spend you to definitely out-of every month to your lifetime of the mortgage or perhaps in one lump sum payment within the twenty five years, or something inside-between is all about handling loans, maybe not modifying our very own property exposure.

If one makes an extra ?fifty,000 fees to your financial, you’ve not had ?fifty,000 significantly more experience of the fresh housing marketplace. Your house coverage remains any sort of your home is well worth.

How to pound-pricing average towards the property market is to buy several services through the years, or perhaps to spend money on an attic extension or equivalent.eight

4. What if you can not make desire costs you might not own your residence?

Some one frequently trust playing with an attraction-only mortgage is more precarious than just a repayment mortgage. You could see which insinuated into the blogs.

There clearly was an atmosphere that a person located in a house funded which have a home loan in which they aren’t paying off personal debt each month was traditions to your a limb.