Lowest doctor loans was riskier than just fundamental lenders, therefore loan providers are more likely to want more substantial deposit to help you accept your loan. Here are around three standard situations:

- A great 20% deposit: Constantly, you are going to need to tell you the absolute minimum deposit that’s 20% of the worth of your house. Also, and no doctor money, particular lenders may want one to pay Lender’s Home loan Insurance (LMI) even for which you has a full 20% deposit protected.

- More than 20% deposit: Both, loan providers require a whole lot larger put. This provides all of them a whole lot more safeguards if you’re unable to create your repayments and they have to sell your residence. The larger your deposit, the lower the pace for your house financing. Their borrowing from the bank merchant can even offer you discounted rates, on level that have full doctor pricing, whenever you set up a good 40% deposit or higher.

- Below 20% deposit: From the other extreme, a number of lenders may offer you lowest doctor financial that have in initial deposit as little as 5%-10% of your own property value your home, susceptible to their particular credit standards.

Not all financial gives the alt doctor otherwise low doctor loan option. Constantly, the bigger finance companies is reduced flexible out of proving your income.

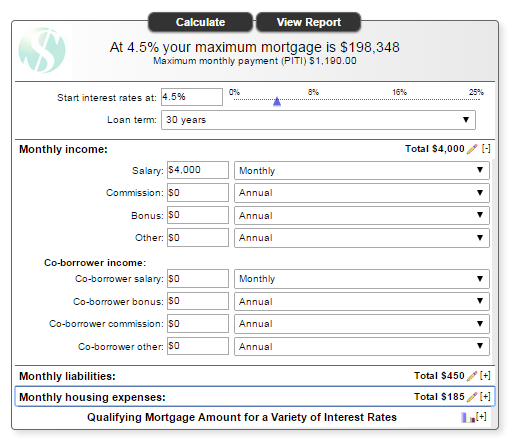

Nevertheless, understanding how far you might use helps you start their lower doc mortgage excursion that have better trust. So we have found a simple summary in order to workout your credit skill.

Borrowing from the bank doing 90% in your home Really worth

Very few loan providers could be ready to make exposure and you can provide you with a reduced doctor home loan that have a max LVR off doing ninety to help you 95%.

Very, if you’re looking for lots more flexible financing alternatives, you will probably find you to definitely non financial lenders become more suitable for your house financing means. Also, you will also must be prepared for much higher rates and high priced LMI, that may run you by the a few thousand.

Full, you might want to apply for a ninety% loan only if you can prove your earnings or if you wish to help you quickly reduce your financing so you’re able to 80% of your property value your house. This will save out of using higher rates for a beneficial a lot of time course.

Borrowing as much as 80% of your house Well worth

Loan providers always agree 80% of your own appraised property’s really worth whenever you give a high put or equity. While doing so, you can access competitive rates, even when a threat percentage may incorporate.

Borrowing up to sixty% in your home Worth

A reduced doc loan during the 60% LVR describes that loan www.cashadvancecompass.com/installment-loans-ks/columbus the spot where the credit doesn’t go beyond 60% of one’s value of your residence. Most low doc loan providers tend to accept the new financing if you are ready so you’re able to contribute forty% deposit otherwise security.

The principle benefit of sixty% LVR reduced doctor home loans was they will certainly ask you for minimal than just a reduced doctor within a higher LVR. This is exactly due to the fact of lender’s ability to build their loan to their harmony layer and you will, oftentimes, may not require LMI.

Ultimately, among the many extremely important criteria discover approved for a decreased doctor 60% LVR mortgage will be self-employed and get an excellent appropriate ABN.

Scenario: Regional Barista Sam

Sam has been an excellent barista-holder at the a little coffee-house for 36 months. Into the organization undertaking better, the guy feels it is the right time to purchase their own family and you can disperse regarding his rented flat.

Sam provides a beneficial credit rating and has already been preserving sensibly for some time to find their dream home. The guy knowledge our home loan business and you can areas within the with the reasonable doctor mortgage option whilst looks best for notice-working people like him.