Get the Data Manageable

You will need certainly to prove you could potentially undertake new duty off a real estate loan. To show what you can do to buy property, you will need the second:

- Proof title (photos ID, always the vehicle operators license or good passport)

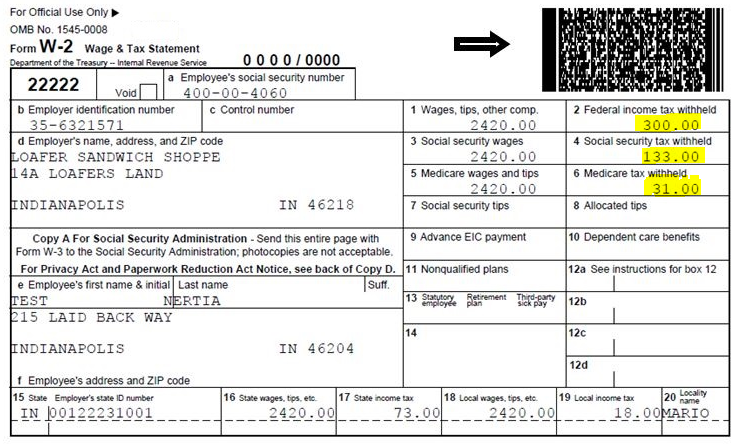

- Proof of work and you may money (paystubs, W2’s / tax statements for 2 age)

- Proof of assets ( two months financial comments but think of, it’s not necessary to has 20% down)

- Evidence of credit rating (a poor credit score does not automatically rule out delivering financing)

Over a software

Finishing a credit card applicatoin can be simply over on the internet with many lenders. Making use of the recommendations more than you have what you need finish the app on better of your ability. Try to be because appropriate that you can; but if you happen to be being unsure of when you’re reacting a concern precisely, don’t worry as this is maybe not a final application. That loan Manager might possibly be examining that which you immediately after distribution and you may go due to items that they want explained.

Completing an application doesn’t obligate that working with one to specific financial, and cannot ask you for anything beforehand. Although not, before-going from application https://paydayloancolorado.net/pagosa-springs/ processes, just be confident that we should work at the newest lender you happen to be completing the application form having. Whether it is comparing online or talking to financing Officer prior in order to doing the applying, you may choose to accomplish best homework.

Rating Preapproved

Once you complete the loan application, your bank will request the new help records in the list above to confirm and confirm the information you have got considering. Good prequalification is simply evaluating all the details you get into to your application, and you will quoting how large of mortgage you may qualify for. A preapproval are a thorough summary of your earnings, property and borrowing from the bank. In the preapproval process, the borrowing try drawn, your information is affirmed, and it’s really situated you are a serious applicant.

Extremely good Real estate professionals in an active sector requires a preapproval before indicating you land, and you can people vendor ahead of acknowledging an offer would want to get a hold of a great preapproval letter one to demonstrates you can aquire our home. A beneficial Sammamish Real estate loan Officer (LO) makes it possible to get preapproved so you can start family search with confidence.

And make a deal/Serious Currency Deposit

Once you’ve located just the right domestic, you will be prepared to make an offer. After you look at the settlement techniques and get an approved render, timelines now start working, and obtaining what you in-line in a timely fashion is very important to using a mellow transaction. Among the first strategies are in initial deposit of your own earnest currency discussed in the package into the escrow. So it usually is step 1-5% of the purchase price depending on how competitive the newest number was.

Authoritative Application for the loan

As soon as your offer is approved, the following actions happen rapidly. Basically, the offer will establish that you have a certain number of weeks to formalize a loan application and start the borrowed funds techniques with a certain financial.

Develop you have already compared prices with loan providers you have in mind operating with, once the now you would be to execute so it decision. Giving a copy of the pick and you may sale contract towards the lender and you will permitting them to learn you will be prepared to go ahead is sufficient if you’ve already finished a loan application for preapproval.

Financing Possibilities and you will Locking a speed

Once you are lower than bargain and then have made a decision to move on that have a loan provider, the loan Administrator would be to update your together with your latest price and you may rates selection. If at all possible, their lender enjoys an on-line product which enables one look for real-time rates and you can will set you back which means you have an idea off what exactly is available currently.