After you sign up for property security financing, you’ll end up at the mercy of a challenging borrowing from the bank query, that may lead to your own rating to decrease from the a few items. It is essential to keep in mind that property equity mortgage would not impression your own borrowing from the bank use proportion since it is a payment loan, perhaps not a beneficial rotating personal line of credit.

But not, when you have just one particular borrowing from the bank on your own borrowing from the bank profile, for example credit cards, a home guarantee mortgage you’ll replace your credit mix, which could produce a small knock to your credit history. Since you create an optimistic payment record by creating on the-time mortgage costs, you could also see your credit history improve.

Similar to property collateral financing, when you make an application for a personal loan, you are subject to a challenging credit inquiry in loan software process. This might adversely perception your credit score.

Given that a personal bank loan try a repayment mortgage and not a good credit line, it will not grounds into the borrowing from the bank application proportion. not, if you utilize a personal bank loan to repay other high-interest credit debt, their credit utilization ratio you’ll drop-off, which will possibly let your credit rating.

In the event the a personal bank loan advances your credit blend, it may bring about a tiny hit on credit rating too. Creating an optimistic payment background may help the get, too.

Was a house security financing similar to good HELOC?

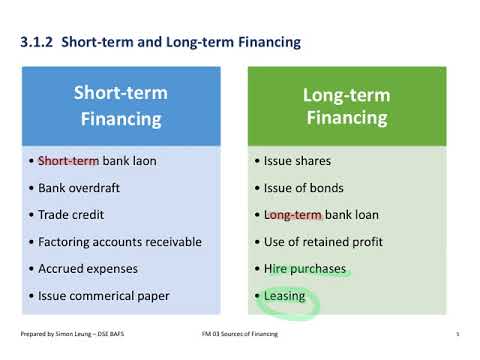

An excellent HELOC and household guarantee financing aren’t the same. If you’re one another loan affairs help you availability collateral of your home, they are different in their framework. When you’re a house security mortgage is actually an installment loan having a good repaired payment, an excellent HELOC functions a lot more like credit cards with a good rotating credit line.

What loans no credit check Hayden exactly are selection to help you a house collateral mortgage or your own mortgage?

- HELOC: Family guarantee lines of credit (HELOCs) is a type of rotating credit one lets a debtor accessibility the house’s collateral. You might withdraw and you may pay off the credit line several times.

- Handmade cards: Particularly a good HELOC, playing cards are a variety of rotating borrowing from the bank. But instead of a beneficial HELOC, playing cards usually are unsecured. And, every so often, handmade cards render an excellent 0% Annual percentage rate basic period, which will play the role of an appeal-totally free mortgage for folks who pay-off the complete harmony up until the promotional several months stops.

- Cash-aside re-finance: Cash-away refinancing lets a borrower so you can re-finance the financial having a keen amount bigger than whatever they already owe. You get the extra matter since the cash, without settlement costs.

Realization

With regards to how to get that loan and and that type is right for you, i don’t have a one-size-fits-all the solution. When you yourself have high collateral of your home, a property collateral loan you can expect to provide a low-value interest choice to fund a task or buy an urgent situation or unplanned bills.

However your house equity is not their just obtainable solution when you you desire money. If you don’t want to place your house on the line and you can don’t require a sizable amount, a consumer loan might be exactly what you would like for the unique private money problem.

In the end, loan providers need to make yes you could comfortably afford your home payment, therefore they will certainly together with pay attention to the debt-to-money (DTI) proportion before approving your for a financial loan. DTI are a metric finance companies use to measure your capability so you can pay off the loan. They signifies the fresh new percentage of your disgusting month-to-month income which you fool around with for the month-to-month financial obligation payments. As a whole, the DTI ratio will must be less than 43% to help you qualify for a home collateral financing.

In addition to interest rates, you can both spend a keen origination commission or an administrative fee which have a consumer loan, which is basically taken from your loan matter when your loan is approved. Ask your bank should your mortgage has a good prepayment punishment in situation you want to pay the mortgage entirely up until the prevent of your label.