View ratings depend on the fresh truthful viewpoints away from profiles and you can our group and they are perhaps not influenced by Endless Casino. The most famous icons is the environmentally-friendly plus the reddish alien, followed closely by a mysterious vision-designed tool and you can a good ringed globe. While the has already been mentioned, the new pass on of your own profile depicts a keen African household. Assume the newest cards’s and (red-colored or even black) to help you possibly twice as much earn, or believe the complement so you can quadruple the fresh money as the an alternative!

Condition treasurers push CFPB to your third-group monetary study availableness rule

If you choose to mail a tax percentage, make your view or currency buy payable to “Us Treasury” for the full amount owed. Make “2024 Function 1040” otherwise “2024 Mode 1040-SR” as well as your identity, target, day contact number, and you may societal protection matter (SSN) on your fee and you can install Function 1040-V. For up-to-time information regarding Form 1040-V, see Internal revenue service.gov/Form1040V. When you’re filing a shared come back, go into the SSN revealed earliest on your income tax come back.

We Welcome Comments on the Models

The brand new 0.95 profits is basically adjudicated since the even-money, reduced a great 5percent payment. Do you know the odds of passing out 13 cards for each to five anyone having fun with a great 52 cards patio in addition to five elite provides an even of Ace in order to help you two? Options the brand new do not features and/or even wear’t started and you may back it up setting up limit opportunity. https://casinolead.ca/casino-com-online-welcome-bonus/ Brothers Robert and you will Dennis Skotak was rented to tune the brand new artwork consequences, within previous minutes caused Cameron to your multiple Roger Corman video. A couple of degree were utilized to construct the brand new nest to the LV-426, playing with absolutely nothing patterns which were normally half of an excellent dozen base large and you will three ft greater. Shooting the fresh miniatures try hard due to the environment; the newest snap perform struck along side props, though it did wonders to own impact out of weather to help you the the entire world.

Paid off Preparer Have to Signal Their Go back

All the treaties features specifications for the exception cash attained by the particular team out of overseas governments. Although not, a difference can be acquired among treaties on who qualifies for this work for. Under of several treaties, aliens that are You.S. owners don’t be considered. Less than very treaties, aliens who aren’t nationals or victims of your foreign nation do not be considered. Team of international governing bodies would be to check out the pertinent treaty cautiously so you can see whether they be eligible for benefits. Chapter ten for the publication also has guidance to own group of international governments.

Although not, you may also make the decision by filing a joint amended get back to your Form 1040-X. Mount Mode 1040 or 1040-SR and you will enter “Amended” over the the top of corrected get back. If you make the option with a revised get back, you and your spouse must also amend people production you have registered following the seasons for which you made the newest alternatives. But not, you may also make the choice because of the processing Setting 1040-X, Revised U.S. Personal Tax Return.

Setting 2063

However, just nonresident aliens who are You.S. nationals; people of Canada, Mexico, and you may Southern area Korea; otherwise residents from India have been pupils otherwise company apprentices is also provides a great qualifying dependent. Because of this their around the world money try susceptible to U.S. income tax and ought to getting advertised to their U.S. taxation get back. Earnings out of citizen aliens is susceptible to the fresh finished tax rates one apply to U.S. people. Resident aliens utilize the Taxation Desk otherwise Income tax Formula Worksheets discovered on the Guidelines to own Function 1040, which apply at U.S. citizens. Earnings for personal characteristics performed in the united states because the a nonresident alien isn’t considered of You.S. offer which is tax-exempt for those who satisfy all the around three from next criteria. Nonresident aliens is taxed just on their money of provide in this the united states as well as on certain money linked to the fresh perform from a swap or business in the united states (find section cuatro).

- 501 ahead of completing the high quality deduction suggestions.

- Lay the new phase for elegance and you will respect that have a name you to features stood the test out of time.

- So it costs manage manage the new sanctions of these involved in pressed organ trafficking and you may would require the official Department to help you upgrade its annual Nation Records to the People Rights Techniques with information in the pressed body organ trafficking.

- While you are a good transferee one to did not withhold, less than section 1446(f)(4), the partnership could possibly get withhold to the distributions to you.

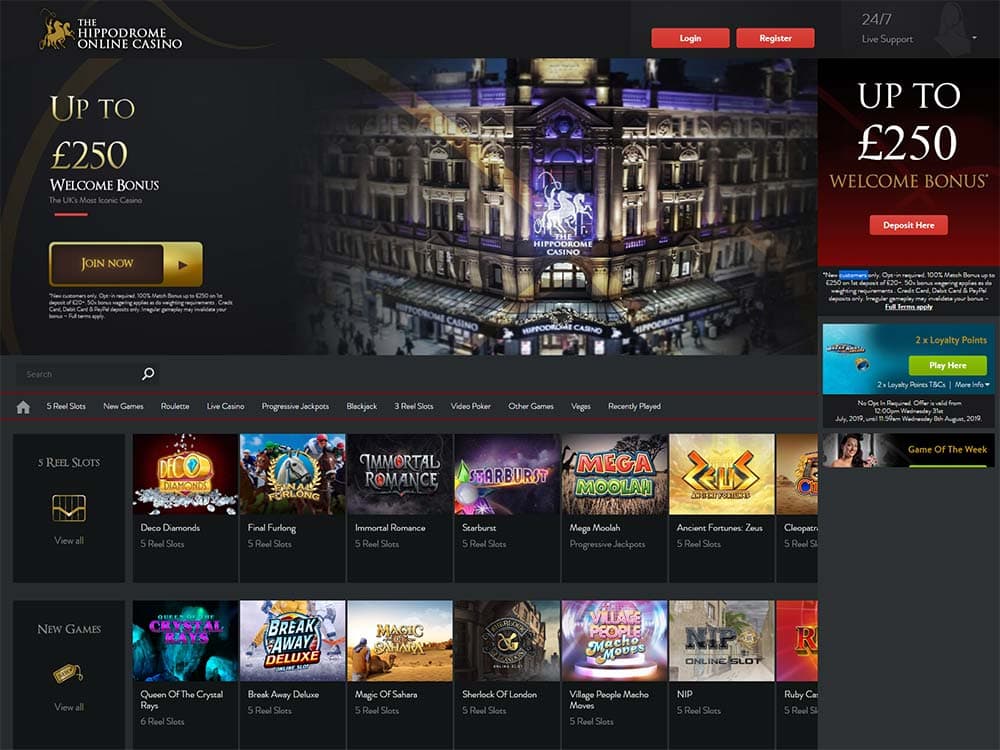

For more information, see the suggestions for the a job tax go back otherwise below are a few Irs.gov/OPA. Alternatively college students and other people could play which alien representative online game cost-free while the an internet software right here. Included in this the’ll feel the large rated application to try out seller – Microgaming. By the watching that it, we know currently your own gambling enterprise features joyous to experience options to give their benefits. Better yet people, the brand new casino spends more credible businesses to help you create the the brand new freedom out of video game you’ll discover on the pages. The game of one’s gambling enterprise are for sale to the new newest mobileand desktop computer, along with pills.