There are lots of other things to notice. It is far from strange locate conditions of at least a good 680 credit rating and you will 20% down. However, talk to a skilled financial to obtain the requirements to have your. He or she can walk you through the main points so you’ll be able to understand what you may anticipate assuming.

End up being the boss out of borrowing.

Money can help you do a little fairly extremely anything, for example buy a home otherwise a car (otherwise a plane pack in the foreseeable future!) Have the Publication.

To acquire a house

Once you choose for to buy a property, you do not score everything you just as you would like it, however obtain the benefit of strolling from room and you will that great house before you can agree to to invest in. Plus, this is usually reduced to acquire than simply generate, and you also get the capability of swinging inside. Below are a few a lot more facts to consider if you find yourself thought of buying a home:

Masters

- There was always an opportunity to negotiate to the supplier which means you can acquire a much better deal.

- Versus strengthening, many select to find as less stressful.

- You will have way more options towards where you are able to buy versus. where you are able to build specifically because you try parts closer to the town where discover property currently built on a good many possessions.

- Than the strengthening, probably you won’t have to hold off ages or purchase many of dollars more to track down adult woods and you will bushes from inside the your own grass.

Drawbacks

- There is certainly increased danger of repairs difficulties with an existing home as compared to a new generate.

- More mature house will get use up all your present day has actually such as for instance unlock flooring preparations.

- No matter how disperse-in-in a position the house was, there will probably probably be one thing you’ll want to renovate or revise even simple things like painting will require extra time and money.

- Compared to the renovating your current household, moving everything to a different house will be go out-consuming. Not to mention pricey.

Financial support

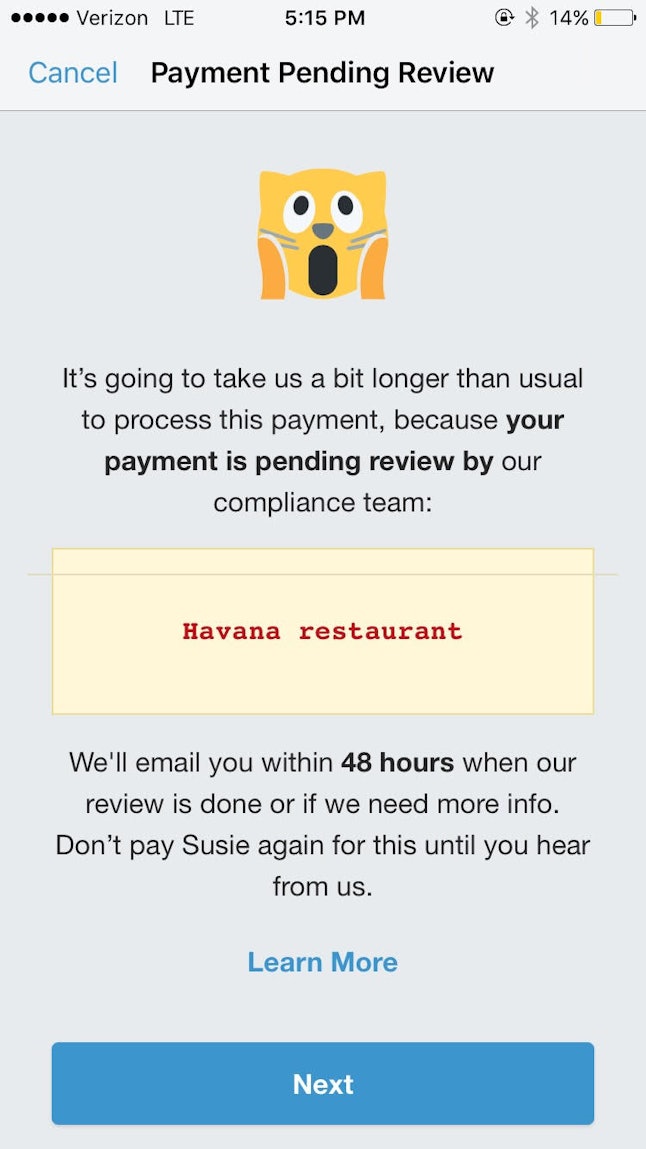

Loan providers will want to look at the credit rating and you will generally want a down payment anywhere between 5 and you will 20%, thus correspond with a loan administrator. On the other hand, you might choose conditions to fit your condition. Instance, you could like a varying interest loan which will give your less commission first or if you may pick the predictability from a predetermined speed loan. Additionally there is along the borrowed funds to look at. Listed here are three well-known style of lenders:

- Antique financing this may be the quintessential better-understood sorts of home loan. You could choose a changeable otherwise fixed speed therefore the length of the financing that’s true to you.

Your best option is always to consult with a loan provider who’s a powerful history of enabling anybody select the resource one to is right to them.

Remodeling property

Remodeling your home was a method to get the best off both planets some great benefits of without to begin with of scrape towards capacity to tailor what you should match your situation. Before you can dive inside, you will need to determine whether your home is well worth committing to. Could it be structurally sound (are there a great skeleton as the saying goes)? Should you decide good dimensions repair, you could pause examine the cost as to what it could attempt go on to a new household if not create oftentimes. Plus you will need to consider whether you’ll recover new https://availableloan.net/installment-loans-nd/ resource you will be making on the renovation if you have a chance which you’ll sell your home later on. Consider these benefits and drawbacks that can come with a renovating project: