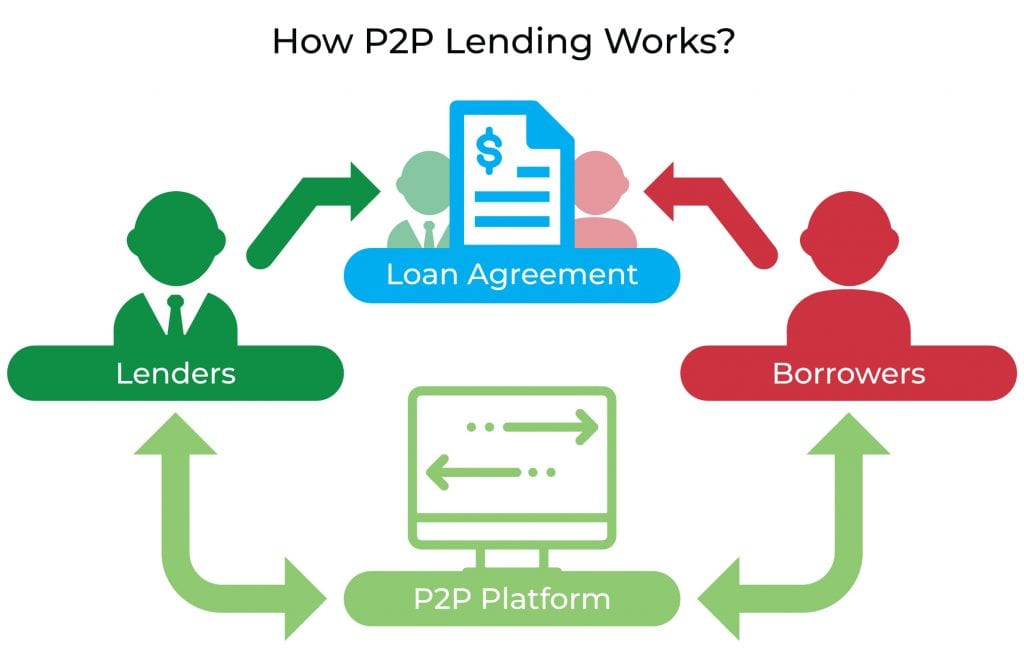

After you submit an application for that loan, your own possible lender will consider their likelihood of settling what they’ve been lending to you personally. They work on checks on your own creditworthiness and you can purchasing designs to guage your financial character and you will and thus determine whether you likely will would their financial and you will pay off them in full.

They will look at your borrowing from the bank and you may installment record, checking handmade cards, overdrafts, hire purchase plans, car and truck loans, signature loans, mortgage loans, and you will power, h2o, energy and cell phone expense. They believe the manner in which you do quick financial obligation might be indicative regarding how you would would a large loan.

Credit monitors

A possible lender is going to run a credit assessment on you and you can may come back that have a score anywhere between zero and you will good thousand. A rating less than 500 and you might struggle to be considered to possess home financing. five-hundred so you can 700 is considered an average risk, and you may people rating over 700 might be better-regarded.

Just what influences fico scores?

Credit history: This includes most of the levels, instance handmade cards, signature loans, or mortgage loans. An extended history of in control borrowing have fun with can be a confident for the credit history. Outstanding debts: Numerous a fantastic costs negatively apply at your credit score given that it means a more impressive range from obligations. Payment record: A from if you made costs timely, which has debts. Later or missed costs can also be hurt your credit score. Credit utilisation: This is the quantity of credit you are playing with as compared to the degree of borrowing from the bank online. Using a premier percentage of their available credit have an excellent negative effect on your credit score. Frequent credit monitors: Credit issues getting loan applications can impact your credit score. For every credit assessment is actually registered on your own credit report. Several borrowing checks inside the a short span is generally translated due to the fact your seeking to loads of borrowing from the bank or sense financial difficulties. Address changes: A stable residential address number will assist your credit score. Bankruptcy: Latest or earlier in the day insolvency on your own document can be regarded as a solid sign of credit exposure.

Playing cards

Whenever banking institutions weigh up how you would provider your financial, might also consider the amount of debt you could potentially enjoys, besides the degree of financial obligation you currently have. This means that, playing cards apply at your ability to borrow secured on home financing once the finance companies will appear at the fact you might take on a great deal more financial obligation. Then they work to the presumption that you’re https://clickcashadvance.com/loans/tribal-loans/ going to holder up as frequently debt as your credit will allow you to. Therefore, the lower the bank card maximum, the greater you can borrow.

Credit card limits

To help you a lender, handmade cards are a liability while they need certainly to consider you to you can draw down on an entire count any kind of time point. You, while doing so, may consider a high limitation in your bank card given that an effective helpful merely inside case’. Very be mindful, that have you to definitely extra money offered could end up costing your dearly with regards to obtaining a home loan.

If you possess the deposit having a home but are striving so you’re able to borrow enough, your charge card maximum could be the deciding cause of financial recognition. Cutting your limitation of $20,000 to $5,000 you are going to imply having the ability to obtain an additional $65,000.

Why? Because the finance companies look at coming possible credit debt when figuring serviceability. For folks who borrow secured on the bank card, according to the bank’s data you will have even less earnings readily available to visit to your mortgage. If you decide to fall behind to your financial obligation, you’d be likely to focus on settling borrowing from the bank card personal debt for the high interest levels and you can thereby putting your residence mortgage money at risk.