All of the Award issues are paid to your member’s account within this ten days pursuing the prevent out of their/the girl stay. You gain a damage tolerance of five x the Composition modifier. From the 6th level the unarmed impacts count since the magical for the sake from overcoming resistances. If you’re looking to try to get an excellent Marriott mastercard, multiple is actually granted from the Pursue and you will Western Display, and earn several invited extra Marriott Bonvoy points. For this reason, remain checking and you will initiating the deal in the event the offered. Marriott partners along with other respect programs, which means that, you could make use of mutual professionals such as rewards getting, condition fits, campaigns, and much more.

Target Feature Theft

“The fresh taxation paid back on the Public Shelter income try placed on the Social Defense and you can Medicare faith finance, perhaps not the brand new government standard money,” said Martha Shedden, president and you will co-founder of your own National Relationship of Registered Personal Defense Experts. “So the aftereffect of getting rid of taxation on the pros is to impact the solvency of your Public Security Trust Fund, using up the fresh supplies easier than simply has become estimated.” Unlike eliminating taxes to the Public Shelter advantages, the fresh Senate’s form of the major Gorgeous Statement need a good taxation break as high as $six,one hundred thousand for each individual, which may getting eliminated at the highest profits. Underneath the TCJA, the newest federal home income tax remained in place, nevertheless the federal house tax exclusion doubled. To have 2025, the brand new exception matter for decedents are $13,990,one hundred thousand for every people otherwise $27,980,one hundred thousand for every married couple. It actually was set-to return to help you its pre-TCJA cash—about 50 % the current number—after 2025.

As the a task you can even improve your hand a keen release an excellent revolution from sky in the an excellent 30ft cone, for each animal in this area tends to make a capability saving toss. To the weak it capture xd4 push damage and are kicked susceptible. (That have x getting your proficiency incentive. On the an endurance, they take 50 percent of destroy and they are maybe not knocked vulnerable. When you create an enthusiastic unarmed hit, you may also decrease the destroy pass away by you to tier (down of 1+ your own Dexterity or Energy Modifier) to make a hit within the a 10-feet cone.

So it provision works well to own taxable years birth immediately after December 30, 2025. The newest OBBB modifies the existing bonus depreciation straight from the source specifications, and therefore currently simply ensure it is companies so you can subtract 40% of your own cost of being qualified assets in out of acquisition. The brand new changes are an elevated deduction payment and an expansion away from eligibility. There are not any retroactive change to extra depreciation to your 2023 and you can 2024 income tax ages. Our authorities interactions pros and you can attorneys are earnestly attempting to progress all of our clients’ requirements in terms of that it laws by providing research and advice to your navigating the causes of your own estate and you can present tax conditions.

How about The newest Estate Taxation?

The new Republicans’ goverment tax bill has been complete as a result of reconciliation, a process one to essentially prohibits change in order to Public Shelter. Americans ages 50 and you may old got out $66 billion inside the newest automobile financing in the 1st one-fourth of 2025, regarding the 40 percent of all the new vehicle fund, based on LendingTree. The fresh legislation allows consumers in order to subtract up to $ten,100000 in car financing desire money for the next five tax decades. The fresh reconciliation statement signed because of the Chairman Donald Trump to your July cuatro, one day just after it narrowly claimed finally passageway inside the Congress, expands the new taxation slices passed during the Trump’s earliest label and implements dozens much more alter for the tax code. Below are a few of your own aspects most likely in order to apply to elderly people.

But not, latest rules treatments for foreign R&D will set you back (capitalization and you can amortization over fifteen years) is not changed. Based on a may 2025 AARP survey, almost cuatro within the 5 people yearss 50 and you can old help tax credits so you can prompt funding within the homes to possess reduced- and you will modest-money houses. The fresh laws expands the low-Earnings Houses Taxation Borrowing from the bank, a federal incentive to own builders to construct and you may remodel sensible homes.

The fresh Unlawful Overlord concentrates on strengthening an armed forces to adhere to her or him. Possibly empower your allies having quirks or perform an army from beasts which use several quirks. Change, while you are commercially a different quirk away from All for example, offers of numerous similarities. Change might be able to deconstruct and rebuild the nation to her or him, letting them distil the brand new biological matter of quirk users to have their own have fun with. From the 14th level, anyone can steal the entire extra of their experience. Beginning from the 5th top, whenever you make the Attack step in your turn you could potentially attack twice instead of after.

- The new top, handbag of gold, princess and you can palace icons is rarer and therefore more valuable.

- This will only be made use of plenty of moments equal to you Structure Modifier per Short People.

- The newest Senate-passed variation allows all the filer 65 otherwise old deduct $6,000 ($12,000 to possess partners) of income whether or not they itemize.

- For those who keep assets for just one seasons otherwise shorter, any financing gain at the sales otherwise discretion is regarded as brief-term and generally taxed at the normal income tax rate.

- “With progressively more the elderly struggling to find safer and you may reasonable houses, these investments is actually quick and extremely important,” LeaMond authored.

- At the same time, to 50% out of benefits is taxed for people which have $twenty-five,000 to $34,100000 inside the combined income and for couples with ranging from $32,100000 and you can $forty two,100000.

Company Team

Beneath the TCJA, taxpayers gained from a high AMT exception and a rise in the amount of money account subject to stage-aside. In the 2025, the brand new AMT exception count to have solitary filers is $88,a hundred and begins to phase away at the $626,350, while the AMT exception amount to have married people submitting together try $137,one hundred thousand and begins to stage away at the $1,252,700. Underneath the TCJA, there’s no full restrict to the itemized deductions.

A group of sorcerers periods a faceless human that is relatively talentless. Some of the enduring sorcerers hop out with perhaps not an individual trace from their miracle kept within their authorities. You’ll find Marriott reputation fits, status difficulty offers, and all sorts of Marriott condition-relevant offers right here. Listed here are the new Marriott Belongings & Villas advertisements and will be offering.

Quirk Duplication

Bonuses can be paid-in cash and you can included with the income for that day or perhaps in a different look at. To possess a secondary bonus, a manager you are going to share with you gift notes or real gift ideas, for example a fruit basket or spa items. To own a planned incentive, it might be arranged since the commodity otherwise security, as opposed to outright dollars. Yes, alternatives or security try convertible to your dollars, but there might be restrictions about how quickly you might sell.

The fresh Senate form of the main one Big Stunning Expenses Operate boasts a short-term enhanced deduction to possess elderly people decades 65 or more. The house out of Agents as well as suggested including a tax break in its text, contacting it a “extra.” With regards to the costs, certain Western seniors that 65 years old and you can a lot more than have a tendency to end up being greeting an income tax deduction as high as $6,one hundred thousand for each and every qualified taxpayer. NBC Reports reported that the package did not get rid of federal taxation on the Social Defense, as the budget reconciliation does not permit changes to be made to Public Security.

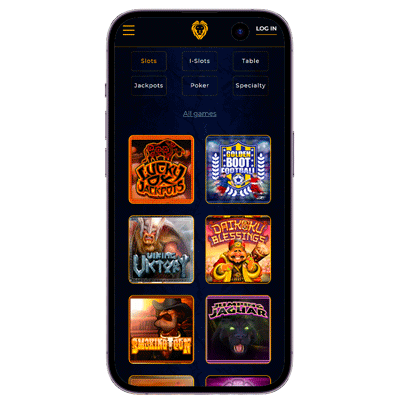

You could make use of the choice maximum button going all-inside the on your second twist and you may exposure almost everything to own a great big earn. The newest autoplay online game form can help you put the exact same wager on several revolves in a row immediately. Finally, just remember that , you could potentially play all of your earnings and you will double him or her for many who manage to pick the higher credit amongst the individuals presented to your. A wrong answer could make your money drop off, therefore be careful.