Everything about Roth IRAs

With a home-directed IRA , you might sign up for a non-recourse financing, that can be used buying property and that is became accommodations. You might think effortless, and of numerous on the economic industry, it is, however of the jargon makes facts IRAs and you will non-recourse finance a little more hard.

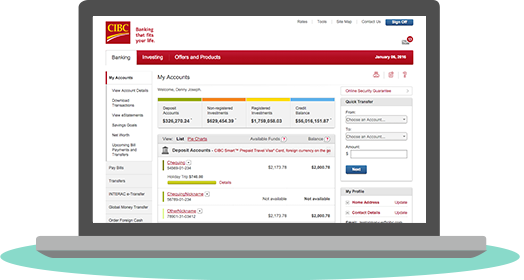

Very first Western Government Discounts Lender will be here to describe how Roth IRAs performs, and exactly how they are used in combination with a low-recourse financing. Learn more from our loan providers, and contact us to initiate the loan application now. I look forward to reading from you!

Roth IRAs keeps income tax masters for the later years.

Having an effective Roth IRA, you could begin delivering income tax-100 % free withdrawals once you reach the ages 59?. Once the Forbes explains, That is unlike this new income tax split you earn of a traditional IRA. Which have those people membership, savers get the chance to help you deduct contributions (doing allowable limitations) using their fees in the same seasons the bucks is stashed on the IRA.

With an excellent Roth IRA, income taxes must be reduced http://paydayloanalabama.com/vredenburgh/ on money before it is discussed with the Roth IRA. It’s a good idea habit about how to begin preserving and you may getting currency to your Roth IRA sooner rather than later – by doing this by the point you’re able to retirement, you could have an excellent nest-egg to gain access to. This really is used in enough intentions, plus resource possibilities.

Roth IRAs be flexible than simply traditional IRAs.

Ideally, zero a person’s dipping to their old age in advance of it’s the perfect time – or at least, no one’s dipping into their retirement while they need certainly to. Self-led IRAs are used for capital intentions, that is a great way to improve debt profile. The great thing about Roth IRAs would be the fact there clearly was smaller chance of punishment to have withdrawing from these fund before you reach advancing years years. When particular criteria was satisfied, just be good to get currency before you could retire, while not having to pay fees or a fee from early withdrawal.

While doing so, Forbes records one to Investment earnings is also tapped early so long as you held the new take into account five years until the detachment. Having said that, if your cash is getting used to own a first-go out household pick, or you be handicapped otherwise die and money was probably their estate otherwise the recipient, currency will be withdrawn sooner than five years with the IRA possession.

You could have one another a timeless and you can Roth IRA.

Some individuals pick a timeless IRA since it is far better having a saving perspective, or because they build too much money to enroll within the good Roth IRA. The Irs has made it easy for visitors to subscribe to each other a good Roth and old-fashioned IRA in the same season. Getting 2017 and 2018, you could potentially lead around $5,five hundred on the combined annual IRA restrict. This can be highly of use, just like the not merely will it leave you extra autonomy, you can choose which IRA so you’re able to withdraw of, depending on what tax and you may economic factors are at confirmed era.

Roth IRAs can be used for investment.

Stocks, home (but simply for local rental aim), shared money financing, and much more could all be utilized which have good Roth IRA. Even as we briefly mentioned, not, a home can just only getting invested in and you will acquired that have a good Roth IRA if it’s not an initial house, of course, if its that have a professional trustee. Our non-recourse loan companies makes it possible to work with your Roth IRA in order to purchase a residential property. See a long list of low-recourse funds and exactly how it works along having care about-brought IRAs by going to our very own IRA webpage .

Our company is in hopes it clears upwards specific affairs and you will facts about Roth IRAs. This can be a very beneficial financial support equipment which could build a beneficial change on your own economic property. Get in touch with Earliest West Government Discounts Bank for more information.