Once logged inside the, navigating using SBI’s site to possess loan declaration down load are member-friendly. New software is made to guide financing consumers effortlessly on the need pointers. From the deciding on the appropriate selection, users can easily to find and obtain the loan comments, enabling these to remain a close attention on their mortgage updates and you will monetary wellbeing.

Safety is the key when being able to access monetary pointers. SBI means that mortgage comments try included in requiring consumers in order to make certain its back ground. This task is vital within the safeguarding private and you can economic analysis, bringing satisfaction so you can people. Shortly after affirmed, being able to access and getting loan comments are a seamless feel, ensuring that individual fund management is both secure and efficient.

The new Bodily Content: Obtaining Their SBI Mortgage Report Traditional

When you find yourself electronic supply is easier, some customers could possibly get prefer otherwise wanted an actual physical copy of its SBI financial declaration. SBI accommodates so it you need by offering off-line choices to request and you can receive financing statements. This particular service ensures that all the people, irrespective of its taste to have electronic or actual duplicates, is perform their loan accounts effortlessly.

Tips to help you Request an actual Duplicate of one’s SBI Home loan Declaration

Asking for an actual content of your own SBI financial statement comes to checking out your nearest SBI part and you can submission a demand. This course of action means users exactly who favor with a paper record of the mortgage comments is actually covered. It is a simple process that SBI provides streamlined to compliment consumer satisfaction and you will accessibility to loan information.

Exactly why you Might require an actual physical Copy of your house Loan Statement

You will find some good reason why users may want an actual duplicate of its financial declaration. For almost all, it is a point of choice to own report records. Others may need they to have specialized purposes, such as tax filings otherwise loan applications. SBI knows these requires while offering alternatives for people to get real copies, making sure everyone’s financial http://www.paydayloanalabama.com/pine-level management choice are satisfied.

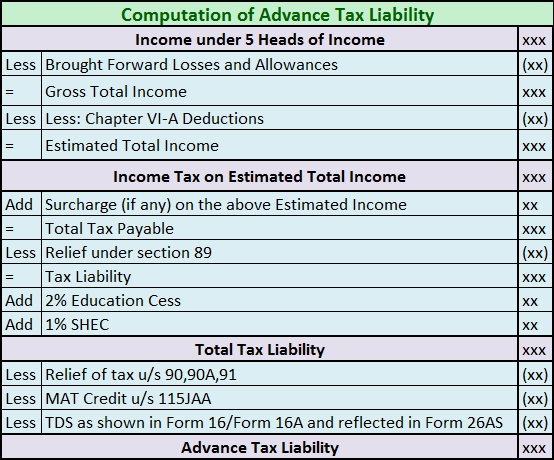

Deciphering the information of SBI Financial Report

Knowing the some parts of their SBI financial report try key to active financial believe. The newest declaration boasts important information such as the prominent count, notice charged, and you will repayment history. This information enables individuals while making told choices regarding their finance and you can overall monetary means.

Information Key terms and you can Rates on the Statement

Their SBI home loan declaration include a handful of important terminology and you will figures giving skills to your financing standing. Terms tend to be;

- Outstanding equilibrium: the amount you still owe on the financial

- EMI matter: the new payment per month you will be making toward paying down the loan

- Period of the financing: the new loan’s complete duration

- Interest rate: the price of the loan

Simultaneously, the fresh declaration contours people prepayments made to your mortgage, giving an obvious picture of just how such as payments impact their a great balance. Familiarizing yourself with this terms and conditions is very important getting effective mortgage administration.

The importance of Record The loan Amortization Agenda

An extensive review of the loan amortization schedule is key getting finding out how each payment influences your loan equilibrium. So it plan stops working money towards prominent and you will interest, appearing the way the mortgage could be reduced through the years. Overseeing this can help borrowers policy for upcoming economic responsibilities and ensure they are making progress to the mortgage payment. Of these going for renting away unlike purchasing can be imagine the big leasing other sites in Asia.

Why The SBI Financial Declaration Issues

Their SBI financial report is over merely a document; its a roadmap of mortgage travel. It offers very important understanding to your loan’s improvements, working out for you create told choices concerning your monetary upcoming. Daily examining their report may help pick opportunities to have best financial believe, such as prepayments otherwise refinancing, ensuring you take control of your home loan effortlessly and effortlessly.