Is it possible you rating a home collateral personal line of credit that have a navigate to the site keen fha financing? Small answer:

A home guarantee credit line is actually one minute home loan note considering collateral of your house. Talking about unavailable from the Government Property Management, but you can receive a beneficial HELOC if you have an.

FHA is a really possessed website, isnt an authorities service, and won’t create loans. FHA try a yourself owned webpages, isnt an authorities institution, and does not build finance. Our home equity financing enables you, as the a citizen, to help you borrow cash while using the equity on your domestic given that collateral.

A home collateral line of credit try a moment mortgage mention based on collateral of your property. Speaking of unavailable from the Government Construction Administration, but you can get a beneficial HELOC if you have a keen FHA loan and create sufficient guarantee inside your home in order to meet the requirements.

When you yourself have way too much guarantee of your house, possibly once the you have repaid their mortgage or just like the business property value your property has increased substantially above the harmony your are obligated to pay to your property, you may be able to see a large loan.

Talking about unavailable from Federal Property Administration, but you can obtain an effective HELOC when you have an enthusiastic FHA loan and build adequate collateral in the house to qualify. An effective HELOC is actually an excellent revolving personal line of credit to possess people so you can accessibility to the financing range restrict as needed.

How much cash home equity loan can i score FHA?

You could potentially obtain to 80% of your own newest worth of your property. Such as, in the event your house is worth $three hundred,000, maximum might be $240,000. Once you’ve paid off your current home loan, then you’re able to receive the kept currency since the a lump sum payment.

Would you feel rejected a property guarantee personal line of credit?

The HELOC is safeguarded of the guarantee you have got on your own family, of course there is no need adequate collateral, you’ll be rejected. You will likely you desire at the very least 20% security in your home before you could was accepted to own an excellent loan of any number.

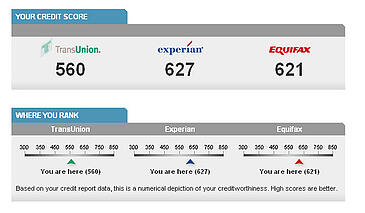

What sort of credit history do you wish to get a beneficial HELOC?

Your credit rating is among the important aspects lenders imagine when deciding for folks who qualify for a property guarantee financing otherwise HELOC. Good FICO Score? with a minimum of 680 is typically needed to be eligible for an excellent domestic equity financing or HELOC.

What exactly is FHA guarantee finance?

Your house collateral loan enables you, as the a resident, in order to borrow money while using the security on your own domestic as the guarantee. The lender advances the complete quantity of with the mortgage in order to the latest debtor, and it is paid off with a predetermined interest over the phrase of loan.

Is it possible you remove additional money on an effective FHA mortgage?

Can be A HOMEBUYER Benefit from the Benefits of A keen FHA Home loan On the An effective “FIXER Top?” Absolutely. An application also known as HUD 203(k) lets licensed buyers buy fixer-uppers which have FHA secured money, and also has established-inside the safeguards to the borrower if the repair and you may restoration techniques cost more than simply asked.

What disqualifies you from bringing a house guarantee mortgage?

A debt-to-income ratio lower than 50% Lenders need one to provides a debt-to-money proportion from 43% to fifty% at most, even though some will demand that it is even down.

Will it be very easy to become approved to possess a great HELOC?

Appropriate credit history requirements differ by financial, nevertheless fundamentally you need a rating on the middle-to-highest 600s to qualify for a home guarantee mortgage otherwise HELOC. A top score (think 760 otherwise significantly more than) usually makes for the most basic qualification process and gives you access to your reduced interest levels.