You simply can’t determine ranging from a personal bank loan, HELOC, otherwise domestic equity financing? To determine and therefore financing suits you greatest, glance at the difference without delay:

Rates of interest and you can Repayment Words

For unsecured loans and you may domestic guarantee finance, fixed rates are ready on package words. These types of rely on individuals points such as the credit rating and you can amount borrowed. Regarding a home guarantee loan, obviously, household guarantee is an additional factor.

In contrast, the attention rates of one’s HELOC is actually variable. Within the very first draw age of a line of credit, you just need to pay the eye to your count you in fact draw but in the following stage of your own payment months, the monthly obligations of dominating try additional. These types of repayments as well as vary into amount withdrawn. Although not, as you do not make payments in the 1st stage and just withdraw money, the pace getting paid off expands steadily. Having said that, the monthly premiums on other a few loans fall off continuously since the the principal is actually paid back.

Amount borrowed and you may Guarantee

Every three finance is actually an effective way to rating dollars. Because home collateral financing in addition to family guarantee distinct credit depict a form of next financial and employ the house since the guarantee, the level of the mortgage try privately linked to the domestic collateral. With an unsecured loan, likewise, the absolute most utilizes several situations, and you will security is normally not necessary. To your high particular personal loan business, finance exists of $1,100000 to around $a hundred,100.

Loan Fee

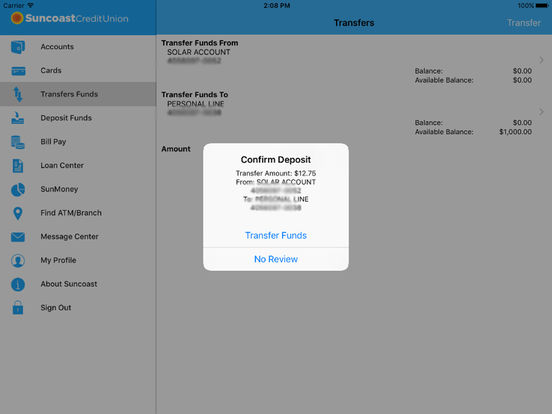

With the personal loan, just as in our home equity mortgage, the whole agreed count was gone to live in your bank account adopting the web link package was signed and you may a certain running go out. That can start around several hours for some months, according to the lender.

Brand new HELOC, concurrently, is far more from good rotating loan that actually works like a cards cards. More than an appartment time, you could withdraw money when you want it.

Annual percentage rate (APR)

Contrasting the 3 finance within annual fee pricing is much more hard. Private fund, the fresh new costs or other charge start from totally free to most pricey, with respect to the merchant. On the other one or two fund, new settlement costs and other charge disagree only minimally however, will vary within organization as well.

Max Fool around with and Taxation Pros

All the around three fund commonly fundamentally tied to objectives and will end up being spent freely. The personal financing are used for most of the significant and minor instructions. If you discover a really positive mortgage which have a low-rate of interest, you’ll be able to utilize it to settle a current, costly financing.

At the same time, a great HELOC and you may house collateral financing is going to be profitable. By using the money to invest in home improvements, you enhance the home guarantee of the home and can in addition to subtract the attention to possess taxation intentions. Definitely, it’s also possible to utilize the domestic collateral loan getting financial obligation installment or other highest expenditures. The house security line, likewise, is especially suitable for typical costs such as for instance scientific costs otherwise university fees charge.

Exactly what When you do?

Prior to deciding using one of your own three loans, you need to be clear about what you need precisely and you may exactly what standards you see. How would you like dollars having a single-big date financing and daily taking place expenses?

Anything you believe: Ideal Eggs has arrived to greatly help! Have a look at our very own Upright Money Talk part for additional information on house improve funding.