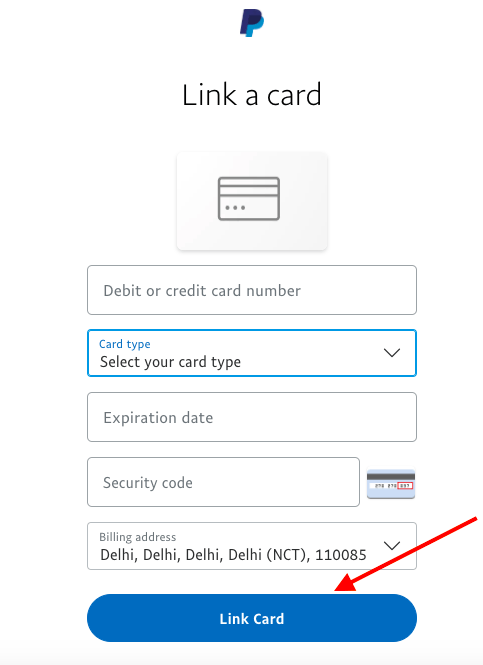

You will additionally you want coupons having settlement costs, which are normally dos-5% of your own loan amount. You pay settlement costs at the time you’re taking control regarding our home. In some cases you might negotiate to split these types of can cost you having the vendor or feel the merchant pay them in return for most other allowances.

With currency to cover the closing costs and you may down-payment for the a merchant account where in actuality the financial institutions can see all of them is important getting an aggressive financial pre-approval. As a result of this youre usually necessary to complete lender statements for the application processes.

step three. Grow and you can Fix Borrowing from the bank

If you don’t get the pre-approval you prefer, delivering a few months to improve their credit might help. Here are some steps you can take:

- Generate into-day payments.

- Generate higher than lowest repayments to invest down loans smaller.

- Talk with credit reporting agencies to get rid of old otherwise inaccurate factors into your own statement.

- Consolidate small-debts on the a much bigger loan. In addition to take note of the rate of interest to be certain your usually do not pay a great deal more fundamentally.

- If you do not has actually a reputation borrowing, open credit cards and you may pay it off each month to show you helps make the new money.

As well as most of these info, you can consult an enthusiastic IMCU mortgage manager locate most and you may custom suggestions for improving your credit score.

Finally, you can try putting other people towards home loan to boost extent you have made recognized having. You can see an individual who was prepared to co-sign, definition it commit to safety this new costs if you standard on the the loan. But not, a great co-signer is not usually entitled to the house or money inside matter.

Is an associate-manager, the person must be a good co-applicant on the mortgage. An effective co-candidate knowledge the credit acceptance process features the income counted as part of deciding the loan number. They are going to additionally be named to your identity of the home and you may show within its judge possession. Taking a great cosigner or co-applicant can increase the amount of home financing.

How to use an effective Pre-Approval Mortgage Calculator

A great pre-recognition home loan calculator enables you to to evolve extent you use, the https://simplycashadvance.net/payday-loans-nd/ length of the mortgage, plus the rate of interest observe just how the monthly premiums alter. Consider, because youre pre-accepted for a quantity doesn’t mean you must purchase anywhere near this much towards the a property. Having fun with a good calculator enables you to see just what your own monthly premiums tend to feel. Following, can be done brand new math to make sure you usually nevertheless features a comfortable funds.

Once you discover payment you are more comfortable with, you are able to shop for residential property where spending budget and set yourself right up for achievement. The fresh new IMCU home loan calculator also lets you factor in a pre-commission to find out if using significantly more to the their home loan in the time of closing, from year to year, or every month, will help you to spend less finally.

Get Pre-Accepted Which have Indiana Professionals Credit Partnership

This new Indiana Users Borrowing from the bank Commitment team out-of mortgage officials practical knowledge on dealing with the mortgage systems. Our solution-first method to credit towards the terms which might be right for all of our people keeps aided us expand relationships with many different realtors. They are are just some of the people which believe me to assist money homes. Once the a card commitment, the audience is a not any longer-for-earnings financial institution that truly aspires so you’re able to real time the fresh new way forward for the goals on your own next family. I receive you to pertain now to have a home loan pre-recognition. Get in touch with all of us on the internet, through email address, over the telephone, or in person, and we will lay our very own minds to one another so you’re able to policy for what is actually next.

How much time Do Pre-Acceptance Past?

That have discounts will not only help you to get home financing, it also helps your stop some charge and you may prepare for others. If you make a deposit off 20%, you might prevent the cost of home loan insurance coverage, that may save around 1% annually. That may not seem like a lot, however, across the amount of an excellent 20-30 year mortgage, it will make sense!